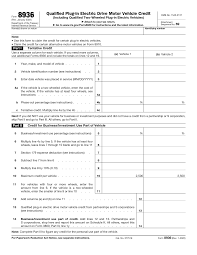

Form 8936 and Instructions

The Form 8936, otherwise known as the Qualified Plug-In Electric Drive Motor Vehicle Credit, is one such incentive that is available to eligible taxpayers.

TRAVERSE CITY, MI, US, December 14, 2023 /EINPresswire.com/ — Electric vehicles have become an increasingly popular choice for drivers looking to reduce their carbon footprint. The federal government has taken notice and is offering incentives to those who own electric vehicles.

The IRS Form 8936, otherwise known as the Qualified Plug-In Electric Drive Motor Vehicle Credit, is one such incentive that is available to eligible taxpayers.

Starting in 2023 and 2024, the Qualified Plug-In Electric Drive Motor Vehicle Credit will continue to provide a tax credit of up to $7,500 for the purchase of new electric vehicles.

This credit is available for eligible electric vehicles. The credit amount will vary depending on the size of the vehicle’s battery and the manufacturer.

This tax credit is part of the government’s effort to promote the adoption of electric vehicles and reduce greenhouse gas emissions. By offering incentives to those who purchase electric vehicles, the government hopes to encourage more people to switch to cleaner, more sustainable transportation options.

The IRS has adjusted the credit amounts available under Form 8936, offering enhanced financial benefits for eligible taxpayers. This revision reflects the government’s commitment to incentivizing the adoption of energy-efficient vehicles and reducing the overall carbon footprint.

The updated Form 8936 includes instructions and an expanded list of eligible vehicle models, encompassing a broader range of Qualified Plug-In Electric Drive Motor Vehicles. This inclusivity ensures that a diverse array of environmentally conscious consumers can take advantage of the tax credit.

The Qualified Plug-In Electric Drive Motor Vehicle Credit remains an important incentive for those considering purchasing an electric vehicle. With the tax credit, the cost of an electric vehicle can be significantly reduced, making it a more affordable option for many.

In addition to the tax credit, electric vehicles also offer a number of other benefits. They are more efficient than gas-powered vehicles, which means lower fuel costs over time.

They also produce fewer emissions, which is better for the environment. And as battery technology continues to improve, the range of electric vehicles is increasing, making them a more practical option for everyday use.

Overall, the Qualified Plug-In Electric Drive Motor Vehicle Credit is an important incentive for those looking to purchase an electric vehicle. With the tax credit, the cost of an electric vehicle can be significantly reduced, making it a more affordable option for many.

As we look towards a more sustainable future, electric vehicles will undoubtedly play a key role in reducing our reliance on fossil fuels and promoting a cleaner, greener world. To access form 8936 and instructions, visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

![]()

Originally published at https://www.einpresswire.com/article/675147621/irs-form-8936-tax-credit-for-qualified-plug-in-electric-drive-vehicles-in-2023-and-2024