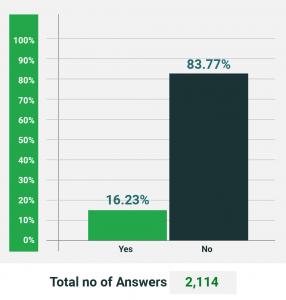

Surprisingly, only 16% are aware that tax entities exclusively select all members of the appraisal district board.

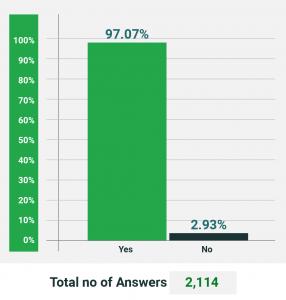

O’Connor unveils compelling data, spotlighting the overwhelming 97% Texan support for public oversight in appraisal districts.

HOUSTON, TEXAS, UNITED STATES, February 2, 2024 /EINPresswire.com/ — Texans overwhelmingly believe public oversight of appraisal districts is warranted. The majority were not aware the current appraisal district boards of directors are comprised only of representatives of tax entities (school, city, county, etc.)

Are you aware the members of the appraisal district board of directors are all selected by tax entities? A survey showed that only 16% of property owners were aware tax entities currently select all members of the appraisal district board of directors.

The budget for 2021 for Texas appraisal districts was projected at $572 MM. The belief that the public should have a seat at the table in governing appraisal districts, won over a full 97.07% in support of the idea. This figure is truly astounding to realize that such a substantial majority are in favor of the concept of oversight. Stated differently, 39 out of 40 Texans responding to the survey affirm the necessity for public oversight of the appraisal districts is warranted.

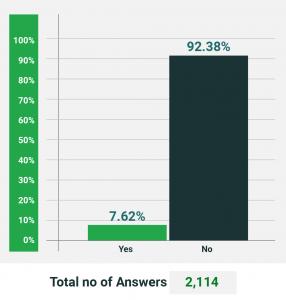

Few Texans are aware that publicly elected members of the board of directors will be selected in 2024. Only 7.62% were aware of the elections to be held for members of the appraisal district board of directors in May, while a significant majority of 92.38% were not aware of the elections.

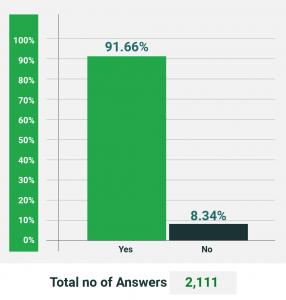

A total of 91.66% believe publicly elected board members for the appraisal district board of directors is a positive step moving forward. Indicating a significant endorsement for increased community involvement in the decision-making processes of appraisal districts.

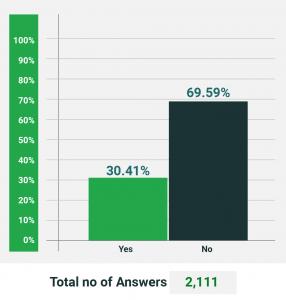

A total of 30.41% of survey respondents were interested in receiving information for running for office and serving on the county appraisal district board of directors, for a total of 642 interested parties. This reflects a significant enthusiasm in participation, indicating a high pool of potential candidates with interest in the roles.

O’Connor has published: 1) FAQs on running for the board of directors, 2) detailed instructions on qualifications and requirements from the Texas Secretary of State, 3) the application for office, and 4) a list of counties with over 75,000 populations, to aid in communicating the information to potential candidates.

*Based on 2,114 survey responses, the appraisal district board of directors has undergone changes that apply to counties with a population of 75,000 or more.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, and commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost-effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program . There is no upfront fee, or any fee unless we reduce property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O’Connor, President

O’Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

![]()

Article originally published on www.einpresswire.com as 97% Of Texans Want Public Oversight Of Appraisal Districts